43 gift card employee taxation

Rewards People Love | PerkUp 9 in 10 employees admit to having lost or forgotten a gift card from their employer 41% of companies reported employee gifting substantially improved retention. 69% of employees say better rewards would increase their loyalty. Tax free gifts to employees - Association of Taxation Technicians The current form of these rules took effect from 6 April 2016, and the key conditions are: The cost of the gift, including VAT, does not exceed £50 per employee. The gift is not cash or a cash voucher - a voucher which can be exchanged for cash. A non-cash, gift voucher which can be spent in a retail store should be acceptable.

De Minimis Fringe Benefits | Internal Revenue Service In addition, if a benefit is too large to be considered de minimis, the entire value of the benefit is taxable to the employee, not just the excess over a designated de minimis amount. The IRS has ruled previously in a particular case that items with a value exceeding $100 could not be considered de minimis, even under unusual circumstances.

Gift card employee taxation

› faqFrequently Asked Questions | Mall Gift Card Provided you have previously registered your Mall Gift Card with your name and address, we will work on your request then cancel your Mall Gift Card and if the Mall Gift Card holds funds of up to at least AED 10, we will replace it with a new Mall Gift Card. Any balance then remaining will be transferred to the new Mall Gift Card. What are the tax implications of employee gift cards? Employers planning on giving gift cards should remember that the IRS regulations support treating all gift cards and gift certificates provided to an employee as taxable income. Although there may be limited situations when the value of a gift card or gift certificate could be excluded from an employee's income, employers might want to take a ... Do gift cards count as taxable income? A. The gift cards are taxable compensation to the employees. If the employer pays the employees' portion of the taxes, that payment also represents income to the employees and is taxable to the ...

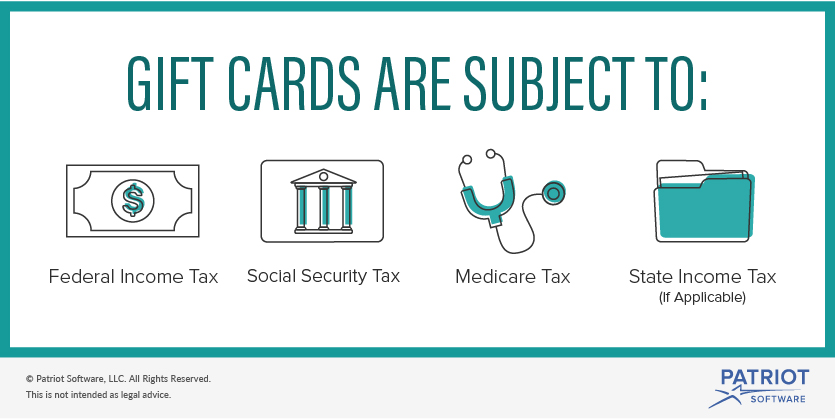

Gift card employee taxation. Reminder: Holiday Gifts, Prizes or Parties Can Be Taxable Wages Thus, when an employer gives an employee a gift, it is taxable under Section 102(c) unless another exception applies. ... but the IRS would view even a $5 gift card to a general retailer as income ... The Gift of Gift Cards: De Minimis and Reporting Rules Unfortunately, gift cards are another story. According to the IRS, since cash and cash-equivalent fringe benefits like gift certificates have a readily-ascertainable value, they do not constitute de minimis fringe benefits. This means that businesses must report gift cards as part of an employee's wages on the Form W-2. Are Employee Gifts Taxable? Everything You Need To Know Gift certificates, gift cards and cash equivalent benefits are never tax-exempt This is something the IRS is very clear about. Even if they are given out as holiday or birthday presents from an employer to an employee, these types of gifts are never considered de minimis fringe benefits, and are thus liable to taxation. Giving Gifts to Employees: Best Practices You can give gift cards to your employees as presents, but your employees must then list the amount of the gift card as income on their annual taxes. Any cash or cash equivalent given by an employer to an employee is considered income by the IRS and must be taxed that way.

Tax Rules of Employee Gifts and Company Parties - FindLaw Cash gifts of any amount are wages subject to all taxes and withholding. Gifts Under $25: Gifts under $25 are typically tax-exempt. Noncash prizes. Include the fair market value in wages subject to taxes. Holiday (or any) parties. Gifts, awards, and long-service awards - Canada.ca If the FMV of the gifts and awards you give your employee is greater than $500, the amount over $500 must be included in the employee's income. For example, if you give gifts and awards with a total value of $650, there is a taxable benefit of $150 ($650 - $500). There are special rules for Long-service awards. Are Gift Cards For Employees Considered Tax-deductible? While the expense of the gift card is completely payable by the company, you must pay tax from the worker's compensation for all these incentives. • Employee protection and performance rewards of real property, such as a watch, can be deducted up to $400 per year per worker. Employees do not have to pay taxes on their awards, but they must ... Can Not-for-profits Use Gift Cards? | Tax Considerations Tax Considerations of Gift Cards. Since gift cards, even for a specific purpose such as to a restaurant or grocery store, are treated as cash, when given to an employee or volunteer, must be recorded as wages. Wages mean that appropriate taxes must be taken out and the entire amount reported on the individual's W-2.

How to Deduct Employee Gifts, Awards, and Bonuses Cash payments or cash equivalent cards you give to employees are considered to be wages and these are always taxable to the employee. Gift certificates that can be redeemed by the employee for retail products also aren't de minimis and they are taxable to the employee. 3 Bonuses to Owners and Employees What Employers Should Know about Giving Gifts to Employees An employer may give an employee a tax-free achievement award only if strict rules are followed. The award cannot be disguised wages that involve cash, a cash equivalent, vacation, meals, lodging, theater or sports tickets, or securities. In addition, to be tax-free, the award must be tangible personal property, Must-Know Tax Rules for Employee Gift Cards: 2022 Update To save on the tax dollars associated with employee gifts, you can opt to build gift card taxes into employee's salary using this simple formula: Face Value of the Gift Card x Tax Percentage/1-Tax Percentage. 3 Big Benefits of Giftogram Gift Cards for Employees and Customers Manage Gift Card Transactions with Giftogram's Reporting Tools › money › personal-financeTaxation Of Employee Stock Option Plans | Mint Apr 18, 2022 · Scenario (a): Manav continues as an employee of company ABC and holds the shares. The shares were purchased in FY 2022-23 (AY 2023-24) and hence tax will be due at the expiry of 48 months from AY ...

Gifts, Employees, and the IRS - Abacus Payroll Employees must report gifts that have clearly delineated monetary values as part of their income for the relevant year, so it's important for you to keep track of the gifts you give. For example, a gift card of any kind, such as a $50 Amazon card, requires virtually no effort in valuing—the actual value is right on the card!

en.wikipedia.org › wiki › Taxation_in_NorwayTaxation in Norway - Wikipedia No social security contribution is paid for income below the exemption card threshold (frikortgrense). This threshold is NOK 54,650 in 2018. [10] Then, social security contribution is paid at a levelling rate of 25% (of the income above NOK 54,650) until this gives a higher total tax than using the standard tax rate on all personal income.

› legal-info › taxationTax Deductions for Employee Meals | Lawyers.com Feb 04, 2019 · Employers and employees can both reap substantial tax benefits when the employer provides or pays for employee meals. Employee Meals Can Be a Tax Free Fringe Benefit. Just about anything employers give their employees as "compensation" for their work is taxable income for the employee and a deductible business expense for the employer. Wages or ...

› l1-visa › taxationL-1 Visa Taxation | Tax Withholding and Payroll Taxes It is a dual intent that allows qualified applicants to adjust their nonimmigrant status to immigrant status and gain lawful permanent residence with the United States green card. L-1 Visa Taxation All non-U.S. citizens and non-U.S. permanent residents are generally required to pay tax on the money earned while working in the United States.

PDF New IRS Advice on Taxability of Gift Cards Treatment of Employer ... and any unused portion is forfeited). However, Federal tax law does not view giving an employee a turkey or a ham as the equivalent of giving an employee a gift card to purchase a turkey or a ham. A recently issued Tax Advice Memorandum (TAM) in 2004 clarifies the tax law and discusses this issue.

Can An Employer Give A Gift Card To An Employee? If you insist on giving gift cards, make sure your workers are aware of the tax implications. According to Jason Fell of Entrepreneur Magazine, the Internal Revenue Service taxes gift cards, even if they are just $5. This implies you'll have to record the gift card's worth as supplemental wages on a W-2 and deduct taxes from the employee ...

IRS Issues Guidance on Treatment of Gift Cards the sale of a gift card (or gift certificate) if: (1) the taxpayer is primarily liable to the customer (or holder of the gift card) for the value of the card until redemption or expiration, and (2) the gift card is redeemable by the taxpayer or by any other entity that is legally obligated to the taxpayer to accept the gift card from a customer ...

When do you tax gifts certificates, raffle prizes, etc. A life insurance company in South Carolina awarded its employees with gift $5 and $10 gift certificates to local department and discount stores without taxing them. The assumption was that they shouldn't be taxed, since they weren't being awarded cash. The Internal Revenue Service took a different view.

Expenses and benefits: gifts to employees - GOV.UK Expenses and benefits: gifts to employees As an employer providing gifts to your employees, you have certain tax, National Insurance and reporting obligations. Businesses There are different rules...

Taxability of Gift Certificates - Washington State University Gift certificates or gift cards to the Bookie, Home Depot, Nordstrom, etc., which are given to employees for any reason and for any amount are taxable to the employee. Payroll Services will tax employees using the earnings type "Fair Market Value" (FMV) or FMS for students. Accounts Payable will provide payment information to Payroll Services.

› blog › payrollAre Gift Cards Taxable? | Taxation, Examples, & More Dec 11, 2020 · First, multiply the gift card value by 22% to find the federal income tax: $100 X 0.22 = $22.00. Now, multiply the gift card value by 6.2% to find the Social Security tax (unless the employee has reached the Social Security wage base): $100 X 0.062 = $6.20. Next, multiply the gift card value by 1.45% to find the Medicare tax (unless the ...

Taxation of Gifts, Prizes and Awards to Employees Policy Summary This policy provides guidance regarding the tax implications of gifts, prizes and awards made to employees so that: 1) proper communication is given to the employee at the time of receipt; and 2) the university is in compliance with federal and state tax laws and regulations. Any question concerning the taxability of a gift, prize or award should be reviewed

Gifts to Employees - Taxable Income or Nontaxable Gift? The tax-free value is limited to $1,600 for all awards to one employee in a year. Gifts awarded for length of service or safety achievement are not taxable, so long as they are not cash, gift certificates or points redeemable for merchandise. Gifts to Customers Many companies also give gifts to highly valued customers during this time of year.

Can I give my employee a gift card without being taxed? Because gift cards are essentially the same as cash, they are considered an easy item to be accounted for and, therefore, taxable. There used to be a threshold of $25 to be the maximum amount that could be gifted before having to be taxed, but that is no longer the case. A gift card or cash equivalent is now taxable, regardless of the amount.

Are Employee Gift Cards Considered Taxable Benefits? According to the IRS, cash, gift certificates, and gift cards are considered taxable fringe benefits and must be reported as wages. But you may be relieved to know that this rule doesn't apply to all gifts or perks that you may give to employees. The IRS tells us that we can exclude the value of a "de minimis" benefit from an employee's wages.

Are Gifts to Employees Taxable? - SST Accountants & Consultants But if the employer gave a gift card to a grocery store for the employee to purchase a turkey, the value of the gift card would be taxable because it is a cash equivalent. For more information, please refer to IRS Publication 5137, Fringe Benefit Guide, or contact the experts at SST for additional assistance.

Do gift cards count as taxable income? A. The gift cards are taxable compensation to the employees. If the employer pays the employees' portion of the taxes, that payment also represents income to the employees and is taxable to the ...

0 Response to "43 gift card employee taxation"

Post a Comment